<Back to Media & Publications>

Most unusual financial frauds around the world

Here is a compilation of 9 financial frauds across the globe in different timelines, covering the process of committing the crime and the way the authorities uncovered it.

1. Sale of the Roman Empire

In 193, AD, the Roman empire was sold! Yes, you got that right. When a Roman Emperor, Pertinax was murdered, and the guards challenged that the throne of Rome is up for sale. Didius Julianus won the bid by announcing the highest value of 25,000 sesterces, an ancient roman currency which he devalued as soon as he became the emperor. The short-lived reign of Julianus is remembered in history because he devalued the Roman currency, which would continue for a long time in Roman history even after his death.(1,2)

2. The 'Water of Poyais'

In the year 1822, Gregor MacGregor of Scotland duped investors a whopping amount which would be around £3.6 billion in today’s time. What Gregor did is known in history as Water of Poyais. A land, which he claimed was his, along Honduras’s Black River, known as Poyais was ready to have investors and settlers. Gregor raised £200,000 directly, and two ships carrying some 250 passengers arrived at the land which to everyone’s surprise, was a wasteland. He was imprisoned and eventually died, but surprisingly, even today the territory of Poyais is barren with no development or settlement.(3)

3. The Ponzi Scheme

The best known financial fraud of recent times was a scheme floated by Charles Ponzi that gave rise to the phrase “Ponzi scheme”. In 1920’s, Ponzi, an Italian conman, launched an investment scheme that promised a return of 50% in 90 days. This attracted several members of the immigrant community of north Boston. His popularity grew until an article on the Boston Post appeared. Ponzi, a charismatic salesman, as defined by many, thought it was his best day when the newspaper posted about him and his of Charles Ponzi. He died in poverty as he suffered a stroke. His fraud duped an amount of about $225 million in today’s times.4,5,6

4. Sale of the Eiffel Tower

Another historical fraud is the Sale of Eiffel Towers. Victor Lustig tried twice to sell the towers; first to Andre Poisson in 1925. Lustig got the idea of selling the tower in a newspaper. Lustig forged the documents, posed a fake government ID, to present himself in front of Andre and five other metal scrapers as a government official, carefully keeping the discussion of selling the Eiffel Tower to be a topsecret as not to encourage a public mutiny. Lustig even went to ask for a bribe from the transaction which would take place to ensure he looked an authentic corrupt government official. Andre was so embarrassed about the cheating that he could not even report the crime while Lustig had eloped to Vienna. Since there was no news reported, the conman thought it could be an excellent time to go back to Paris and tried selling the tower once again, but this time the new victim was smart, and he reported Lustig to police. However, Lustig had once again fled, this time to the US. He started conning people in the US as well and landed in prison only in 1935 when his girlfriend turned him to the Federal authorities. Lustig had escaped from the sentences at least 50 times and served only 12 years before he died in 1947. The money which was confiscated back then is almost 1 million in today’s dollars.(7,8)

The historical Ponzi scam of Bernard Madoff, also known as one of the most massive Ponzi Scam, duped people for seventeen years, using an ingenious trading strategy, the split strike conversion. Madoff, using the funds raised from new investors paid his existing clients who wanted to cash out. His scam saw the light when the US market witnessed a decline in 2008. Interestingly, his sons who were working in his firm were unaware of this scheme, and upon his confession to them, they turned Madoff to the federal authorities. His scam was running for decades only because of the use of a legitimate strategy. Madoff was convicted in 2009 for 150 years of imprisonment, and his fraud had duped $170 billion.9,10

6. The Kubus Scheme

Continuing with the unusual ways with which the scams are covered, Kubus scheme, another Ponzi scheme came into existence in the 1980s. Adriaan Nieuwoudt took inspiration from his grandmother and created a business of selling dried plants to produce thick milk for R 500 (South African Rand), producing ten jars of culture a week. In return, he decided to pay R10 per envelope or R100 per week to anyone who would send him a teaspoon of the culture. This out of the blue idea attracted thousands of South African customers who bought the culture from Nieuwoudt and encouraged others to the same. Nieuwoudt also promised that he needed an enormous amount of this dried powder to develop a skin cream. When the South African government declared this idea as illegal, the scam came out in public, and it turned out to be a pyramid scheme since there was no product or skin cream. The scheme had conned people for R140 million. Nieuwoudt was sentenced for eight years but served for one year only. He was later involved in various moneymaking schemes.(11,12)

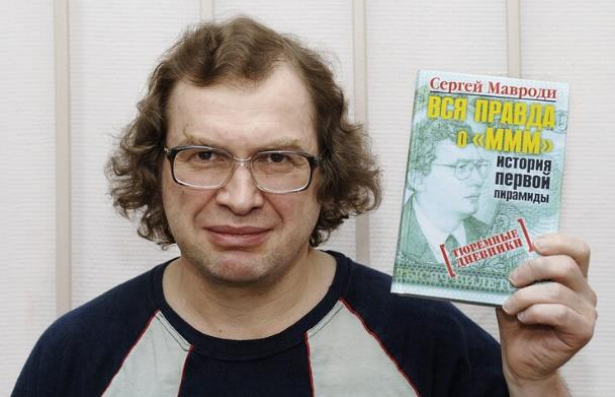

7. The MMM scam

In the world full of scams, a name which is synonymous with both Bernie Madoff and Charles Ponzi is of Sergey Mavrodi. The empire built by him was conceptualised in MMM, a company by his two brothers and himself in the early ’90s. It was rumoured that the employees of the company were limited and could not count money received from the investors, and hence MMM came up with their currency. A promise of 1000% return, the scheme worked until 1994 when the Russian government-initiated action against MMM on tax evasion charges. He tactfully blamed the government for his arrest and for the money, which was lost, eating all the sympathy from the public who believed him. His release even resulted in him in being elected in the parliament. He was arrested again in 2003, released in 2007 and he yet again he brought a new scam targeting the internet generation, globally, called the MMM – 2011. These operations were shut down in countries like India, China, South Africa. The Russian government reported that Sergey died of a heart attack last year.(13,14,15,16)

8. The Ant Scheme

Another swindler hailing from China, Yilishen Tianxi, used ants as the scheme to con people. The Ant Scheme of Yilishen Tianxi started in 1999 with a scheme which had ant farmers who were given boxes to farm the ants along with an instruction manual. People invested their savings in these boxes which Yilishen’s company would pick up in 74 days, and in exchange, the farmers would earn 30 % annual returns on their investment. The dried ants inside the box claimed to be a kidney purifier when grounded. Yilishen was arrested in 2007. During his prime time, it was alleged that he had bribed the Chinese government to portray the scheme as a legitimate business venture. Interestingly, he was highly endorsed by Bao Xishun and Zhao Benshan, two eminent Chinese personalities. Ant Scheme had duped more than $1.2 billion worth of savings.(17,18,19,20)

9. The Emu Bubble scam

Coming home to the unusual Indian Ponzi scams, let’s talk about the Emu Bubble scam. The mastermind behind the unique scam was M S Guru who ideated the fraud in 2006 by promising a return on INR 3.34 Lakhs in two years for an initial investment of INR 1.5 Lakhs. The scheme also provided the investors three pair of chicks after the investment of INR 1.5 Lakhs. The infrastructure to rear the birds, maintenance at INR 6000 a month plus a yearly bonus of INR 20,000 was also offered to the investor. Guru lured the investors until he failed to pay the monthly maintenance fee to the investors and discovered Guru absconding 12,000 exotic birds and conned investors on their own. Guru was arrested in 2012 and is known to dupe more than INR 500 Crores.(21,22,23)