<Back to Media & Publications>

India's Infrastructure: The Road Ahead

Introduction

Infrastructure sector has been the key driver of the Indian economy since ages. Infrastructure can be viewed as a tall tree with lot of different branches namely; Roads, Railways, Ports, Aviation, Power, Bridges, Housing, etc. Infrastructure development is vital to the growth of these sectors and the economy as a whole. Infrastructure got a boost due to Globalization, Population growth and Urbanization in the country. The Government of India has significantly increased its infrastructure spending over the last 10 years, to bridge the gap between infrastructure demand and supply, with an aim to provide the nation with the world class facilities. In the Union Budget for FY 2018 -19, Finance Minister announced the investment of Rs. 50 Lakh Crore for Infrastructure sector along with some major projects especially for roads, railways and waterways expansion, which is highest of all times. Investment from private sector has also been proactively encouraged by the Government to speed up the development and ensure the timely completion of projects.

Global Recession- Indian Economy - Politics and NPA's

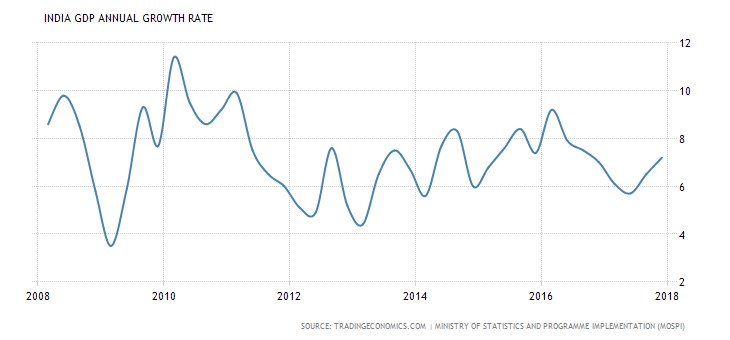

Year 2008 witnessed global recession with the fall of major financial institutions around the world. Unregulated mortgage lending by banks to subprime borrowers gave rise to this crisis as the borrowers did not have adequate repaying capacity. Indian economy also felt the heat of recession. The FDI (Foreign Direct Investment) started drying up and this sudden vanishing of financial credit from market had a huge affect on the infrastructural development projects and also gave rise to the NPA's. India managed a growth rate of 6% in 2009 which was a significant drop from 9% growth in 2007-08 but exceeded World Bank's forecast of 4% growth rate.

Even the corporates with huge loans survived this crisis situation without any bail-out from Government which was comparatively better than other countries where the large corporates were going bankrupt and falling apart. This resilience in the face of crisis led to foreign investors returning to Indian markets with total investment close to $1billion by May 2009. Indian stock market also jumped up and recovered from this crisis by starting of the year 2010. The high Non- Performing Advances in the Infrastructure sector were a product mix of economic slowdown and banks urge to give credit to big players in infrastructure sector without any due diligence check.

Indian Politics also led to the infrastructure sector dysfunction in that period and in the years ago. Since the Post-independence era, the government led a state-centric approach to infrastructure development, by building, owning, and managing projects. This system created a host of inefficiencies, after years of unmet demand and growing financial constraints, the government opened the sector to private investment as part of its economic liberalization in the early 1990s. However, 100% FDI inflow allowed by the Government in India till 2005, gave rise to realty sector bubble as massive black money poured in the economy, Corporates forged their balance sheets during the economic slowdown and lot of scams came to limelight in housing, coal, power sectors, as the companies were unable to repay their advances on time.

The reasons for delay in repaying the debt mainly range from - land acquisition, cost overruns, utility shifting, poor performance of contractors, environment/ forest/wildlife clearances to dispute with contractors. This all added to the NPA problem with the major banks of the country, which is still one of the biggest worry for the Government.

Stressed assets, in the Infrastructure sector alone, reached to 17.4% in FY13 and were 18.6% by September 2016. According to Reserve Bank of India "Financial Stability Report" Dec 2017, Gross non - performing advances (GNPA's) of the banking sector may rise from 10.2% of gross advances in September 2017 to 10.8 % in March 2018 and further to 11.1 % by September 2018.

Policies & Regulations to Tame NPA's & Boost Investment

RBI has revised framework for quicker and time bound resolution of stressed assets recently. In past years, several steps such as CDR SDR, S4A were taken to resolve the stressed assets situation but were not that fruitful. Therefore, RBI made the Insolvency and Bankruptcy code as the main tool to deal with defaulters. Lenders will now need to report the credit information of all borrowers having credit exposure above Rs 5 crore to CRILC. Apart from this, they need to report all the entities in default on a weekly basis. All the above policy frameworks, will lead to an ecosystem where NPA's would get recognized on time and their resolutions will be quicker than before. According to CRISIL, this move by RBI has come at the right time as the asset quality pressures are near their peak and will improve the ability of banks to transit to the new regime. The rating agency also said that, the independent credit evaluation of the residual debt and minimum investment grade rating for any upgrade of NPAs, will improve investor and other stakeholder confidence over the long term.

Outlook for Investors

Indian Infrastructure Investment Forecast

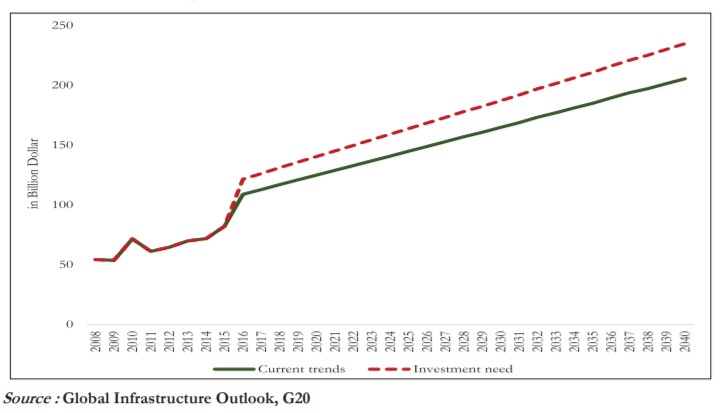

According to Economic Survey 2018, the market size of Infrastructure sector in India is forecasted to be US $4.5 trillion worth of investments till year 2040 to compete globally.

Policy makers are aware of the funds required to bridge this gap and are putting policies in place for encouraging the PPP model to fund the projects. According to a statement by the World Bank, " Private investment in India is expected to grow by 8.8% in FY 2018-19 to overtake private consumption growth of 7.4%, and thereby drive the growth in India's GDP in FY 2018-19." India's GDP growth in the last one year has been impacted by Demonetization and implementation of a nation-wide tax, GST.

In the coming years, investors will see multiple opportunities with a large number of infrastructure projects in pipeline such as "Bharat Mala" (estimated cost of INR 5,35,000 Cr.), "Sagar Mala", Bullet train, Housing for all, Smart City development (INR 2.04 lakh Cr.) etc.

However, for attracting investors, it is also important to consider infrastructure initiatives taken by the neighboring countries as the Indian growth is first compared with the sub continent nations like China, Bangladesh, Pakistan etc. The Geopolitics in the subcontinent can be a threat to Indian Infrastructure and it's forward march towards global economic integration, especially from the Chinese front. Chinese infrastructure initiatives have created shivers in the neighborhood & beyond.

To overcome this situation, India should seriously consider connecting the “Bharat mala” project to the Myanmar, Thailand road project & extend it further into the ASEAN for greater economic integration. The SPV announced in Budget 2015, with a view to establish industrial units in Myanmar, Cambodia, Laos & Vietnam, should be integrated with this road project. While China is keen on the BCIM (Bangladesh, China, India, Myanmar) road project, India should initiate its own BIM project. Integrating the “Bharat Mala” project to BIM can be fruitful in near future. India should integrate Vietnam too into the grouping to strengthen its position. This all will lead to perceiving India as SE Asian leader and will definitely make it a Global Power which in turn will attract investment.

However, with formation of NDA Government in 2014, India has improved its relations with the neighboring countries. China made a modest commitment of $20 billion funding over five years, primarily dedicated to the modernization of India’s railway and the development of two industrial parks. Japan had also pledged for $33.8 billion deal with India in 2014 to boost infrastructure in the country and in turn benefit the high-speed rail service companies in Japan who face competition from China.

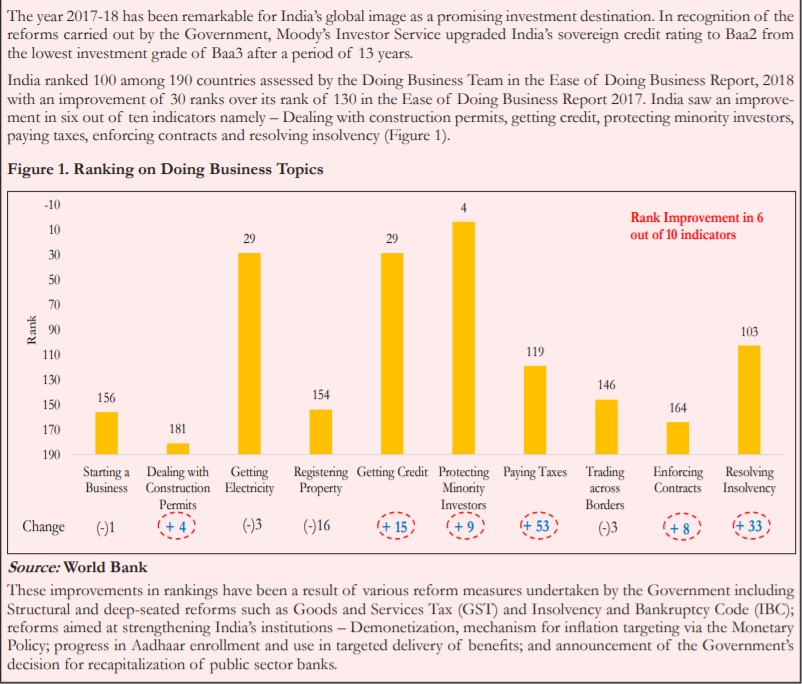

Apart from the neighboring factor, India should also create an image which can woe investment. With the framing of expansionary fiscal policy across the globe, it is important for Indian Government to ensure that investment opportunities remain attractive at a global level, and the country remains an attractive destination for foreign capital, especially with a view to bridging the infrastructure gap. Execution of IBC and RERA, are two courageous steps which showed flexibility and awareness of the situation on part of the policymakers. It is propelling cash flows and India jumped to 4th place among Asian countries for FDI.

Ease Of Doing Business - India Ranking

When investing for the long term, the investors look for - the earnings outlook for the sector should be profitable and valuation of the sector should be really attractive. Considering these factors, the sector which currently fulfils both of these conditions is infrastructure. This is one sector that has been undershooting the market for nearly a decade now. This makes the opportunity in the infrastructure sector quite attractive based on current valuations, policy frameworks and positive outlook for the sector in 2018-19 by rating agency Ind-Ra.

Despite this, Investors should look out for the Indian capital market reforms, as there are limited municipal bonds for long term debt. A recent ban by the Reserve Bank of India, on public sector bank purchases of new infrastructure bonds has impacted the efforts of raising funds through the bond market, this gives a sense of insecurity on part of central bank in infrastructure companies. Also, India will have elections in 2019 as the current Government will be completing its 5-year term, hence, if some other political party comes into ruling, there can be an environment of regulatory changes in the country which can impact the current investment environment.

Disclaimer: All the information is sourced from Secondary Research and the writer is not responsible for any discrepancy.